In part two we'll discuss how to fix your credit score. Have you ever been tempted to respond to one of those advertisements that promises to fix your credit? I thought about it too because credit repair sounds like a good idea; until I found out that they want money. Let me be clear to all of my readers, the only way to improve a credit record is to...

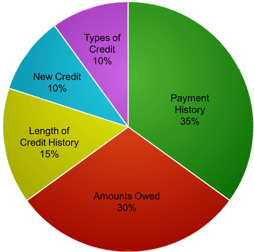

Establish a record of on-time payments and to let time pass on the oopsies you've make in the past. With that being said, your credit score is made up of 5 areas:

- 35% of your score is the payment history: Key here is to pay your bills on time!

- 30% comes from the amount owed: Keep ALL CREDIT CARDS UNDER 1/3 OF THE BALANCE.

- 15% is the length of credit history: Don't be to quick to close credit any open accounts you've had for a long time.

- 10% is from new credit: I hate explaining this one because people think I want them to go out and get new credit. NO! If you are in my office because you are trying to build your credit I'm not going to tell you to go and get new credit!! Opening up new credit will hurt you in the beginning but it will help over time. I'll explain this topic in detail in a later article (stay tuned).

- The last 10% is based on the types of credit you use.

Unfortunitly, it is easier to mess up your credit up than it is to fix it. Overcoming the hurdles takes time, but it's well worth the wait. There's nothing better than hearing the words "You're Approved" when you don't have the cash to pay for the thing you want.

If you'd like to learn more about Guest Author and Expert Coretta Herring, visit Pathways to Financial Empowerment for other great credit and financial empowerment advice. Preparing To Be A First-Time Homeowner In Milwaukee? Click here for 5 Things To Consider or consider clicking here to learn about how to buy a house in Milwaukee.

Want to read Part One of this Boot Camp series? Click here to read about Overcoming Credit Obstacles to get a Mortgage

More questions about Strong Blocks, click the button below.

Written by Coretta Herring, Pathways to Financial Empowerment

Coretta Herring is Financial Coach for Pathways to Financial Empowerment and Real Estate Agent for Any House Realty. Prior to that she worked for Keller Williams and ACTS Housing serving as a counselor helping individuals renting properties owned by the City of Milwaukee transition into homeowners. Coretta has more than 13 years of credit counseling experience, serving, most recently, as the Financial Opportunity Center Program Manager for Riverworks Development Corporation. Corretta previously worked for the City of Milwaukee Neighborhood Improvement Development Corporation as a Community Outreach Liaison and, for a decade, at the Boys & Girls Clubs of Greater Milwaukee, most recently as the Family Service Director. She has a Bachelor of Arts degree from Upper Iowa University. Many years prior to joining ACTS, Coretta purchased a home through ACTS in the ACTS North neighborhood, where she currently resides. You can email her at pathways2financial@gmail.com